Financial Management for DAOs and Web3 Projects: Beyond the Hype and Into the Ledger

Let’s be honest. The word “treasury” in crypto often conjures images of a digital Scrooge McDuck vault, overflowing with cartoonish piles of tokens. But the reality of financial management for decentralized autonomous organizations is far more complex—and frankly, more interesting. It’s less about hoarding and more about steering a ship where every crew member has a map and a vote.

DAOs and Web3 projects manage assets worth billions. Yet, their financial operations are often a patchwork of spreadsheets, multi-sig wallets, and community proposals. This isn’t just an accounting problem. It’s a fundamental challenge of aligning incentives, ensuring sustainability, and executing a vision—all in public, on-chain. So, how do you manage money when everyone’s watching, and everyone has a say? Let’s dive in.

The Core Pillars of DAO Financial Management

Think of DAO treasury management as resting on three shaky, but essential, legs. Remove one, and the whole thing topples.

1. Transparency & On-Chain Accountability

This is non-negotiable. In traditional finance, audits are periodic events. In Web3, the ledger is the audit, happening in real-time. Every inflow, outflow, and transfer is visible. This builds incredible trust but also demands impeccable behavior. A single questionable transaction can spark a “rug pull” panic. Tools like Etherscan, Dune Analytics, and Nansen have become the de-facto financial statements for Web3 project financial operations.

2. Diversification & Risk Management

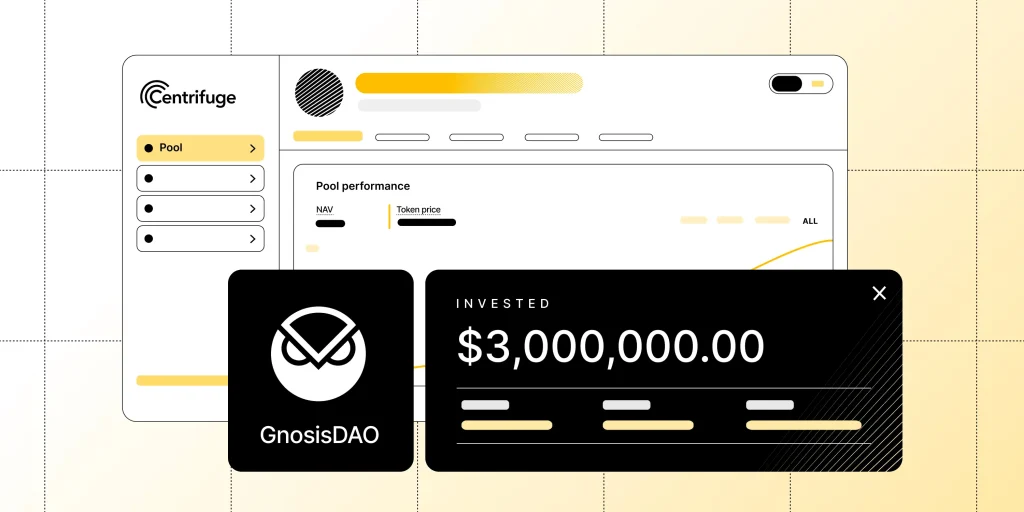

Here’s a classic pain point: a DAO’s treasury is 95% its own native token. When the market dips, both the token price and the treasury value plummet—a double whammy that cripples runway. Smart DAOs are now thinking like mini-sovereign wealth funds. They’re diversifying into stablecoins, blue-chip assets, and even real-world assets (RWAs). The goal? To create a buffer against volatility and fund operations regardless of token price swings.

3. Sustainable Spending & Runway

How much runway do we have? It’s the question that keeps project leads awake. Calculating this in crypto is tricky. You need to account for vesting schedules, token unlocks, and fluctuating asset values. The key is to establish a clear budgeting process funded by a diversified treasury. This means funding development, marketing, grants, and operations without burning through the community’s war chest in two quarters.

The Nuts and Bolts: Tools and Tactics

Okay, so we know the principles. But what does this look like day-to-day? Here’s where the rubber meets the road—or rather, where the smart contract meets the signature.

Multi-Sig Wallets & Spending Policies

Gnosis Safe (now Safe) is the cornerstone. It replaces the single CEO signature with a requirement for, say, 3-of-5 trusted signers to approve a transaction. But who are the signers? How are they chosen? What spending limits trigger a full community vote versus a quick execution? A clear, on-chain spending policy is your first line of defense.

Streaming Payments & Vesting

Paying a contractor a lump sum of 50 ETH upfront is risky. What if they ghost? Tools like Sablier and Superfluid allow for token streaming. Funds drip to the recipient over time, aligning payment with work delivered. This is also perfect for vesting contributor rewards, making incentives long-term and sticky.

DeFi Integration for Treasury Growth

Letting assets sit idle is, well, a missed opportunity. Many DAOs cautiously deploy a portion of their stablecoins into low-risk DeFi strategies—think lending on Aave or providing liquidity in deep pools. The yield generated can help pay for ongoing expenses, effectively creating a flywheel for the treasury. The keyword here is “cautiously.” Smart contract risk is real.

| Common Treasury Tool | Primary Use Case | Consideration |

| Gnosis Safe (Safe) | Multi-signature asset custody | Signer selection is a governance challenge |

| Llama (formerly Utopia) | Budgeting, payroll, & reporting | Great for internal transparency |

| Sablier / Superfluid | Streaming payments & vesting | Aligns incentives over time |

| Syndicate | Investment clubs & legal wrappers | Bridges on-chain & off-chain worlds |

The Human Hurdles: Governance and Getting Stuff Done

You know, the tech is often the easy part. The real friction? People. Decentralized finance management means navigating governance with all its beauty and chaos.

Proposal fatigue is real. Should the community vote on every $500 Discord bot subscription? Probably not. The trend is towards delegated budgeting. The DAO approves a large quarterly budget for a specific workstream (e.g., “Developer Ecosystem”), then empowers a small, accountable team to manage those funds. It’s decentralization with operational efficiency.

And then there’s contributor compensation. How do you value work in a global, anonymous collective? Fixed salaries in stablecoins? Token rewards? A hybrid? Getting this wrong leads to burnout or misaligned incentives faster than you can say “hard fork.”

Looking Ahead: The Future of DAO Treasuries

The landscape is evolving, fast. We’re starting to see specialized DAO treasury management roles emerge—”Treasury Stewards” who are part CFO, part DeFi strategist. The rise of legal wrappers (like the Wyoming DAO LLC) is creating frameworks for real-world expenses and tax compliance, a messy but necessary step.

Perhaps the most exciting shift is the move from passive treasuries to active, productive ones. Treasuries aren’t just bank accounts; they’re the engine of the protocol. They fund grants to bootstrap ecosystems, provide liquidity to critical pools, and stake to secure networks. The treasury is the business model.

In the end, financial management for DAOs is about building something that lasts. It’s about moving past the initial euphoria of fundraising and into the gritty, unglamorous work of stewardship. It requires a blend of blockchain savvy, traditional finance prudence, and a deep respect for the collective. Because that vault of tokens? It’s not just a war chest. It’s the community’s shared faith in tomorrow, locked in a smart contract. And that’s something worth managing with care.